Introduction

Gold has long been revered as a symbol of wealth and a reliable store of value. In recent years, smaller gold bars, such as the 20g gold bar, have gained popularity 20g gold bar among investors. These bars offer an affordable entry point into the world of gold investment while providing the security and stability associated with precious metals. This article explores the features, benefits, and considerations of investing in 20g gold bars.

Understanding the 20g Gold Bar

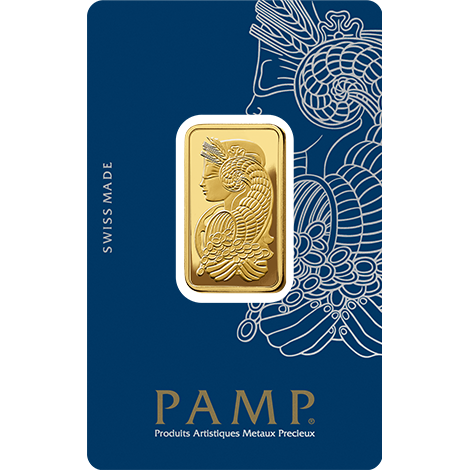

A 20g gold bar, weighing approximately 0.64 ounces, is a compact and convenient form of gold investment. These bars are typically crafted from fine gold with a purity of 999.9 (99.99% pure gold), ensuring high-quality and consistency. Produced by reputable mints and refineries such as PAMP Suisse, Perth Mint, and Valcambi, 20g gold bars are recognized and accepted worldwide.

Advantages of Investing in a 20g Gold Bar

-

Affordability: The 20g gold bar is more affordable compared to larger bars like the 1kg or 100g gold bars. This lower price point makes it accessible to a wider range of investors, including those who are new to gold investment or those looking to diversify their portfolios without a significant initial outlay.

-

Portability: Due to its small size and weight, the 20g gold bar is easy to store and transport. This portability makes it a convenient option for investors who may need to move their assets or prefer to keep their gold in a secure, easily accessible location.

-

Liquidity: Gold bars, including the 20g size, are highly liquid assets. They can be easily bought and sold in the global market, providing flexibility for investors who may need to liquidate their assets quickly.

-

Gifting: The 20g gold bar is an ideal size for gifting. Whether for a special occasion like a wedding, anniversary, or graduation, a 20g gold bar makes a memorable and valuable gift. Its size and elegant packaging often enhance its appeal as a thoughtful present.

-

Diversification: Investing in a 20g gold bar allows investors to diversify their investment portfolio. Gold often serves as a hedge against inflation and currency fluctuations, providing stability during economic uncertainty.

How to Purchase a 20g Gold Bar

-

Choose a Reputable Dealer: To ensure the authenticity and quality of your 20g gold bar, purchase from reputable dealers or directly from renowned mints. Research the dealer's reputation, customer reviews, and ensure they provide transparent pricing.

-

Verify Purity and Certification: Check that the gold bar has a purity of 999.9 and comes with a certificate of authenticity. This certificate should detail the bar's weight, purity, and a unique serial number, which helps in verifying its legitimacy.

-

Consider Storage Options: Proper storage is crucial to 20g gold bar protecting your gold investment. Options include home safes, bank safety deposit boxes, or specialized storage facilities. Some investors also choose to store gold in allocated accounts offered by bullion dealers.

-

Understand Market Conditions: Gold prices can fluctuate based on various factors, including economic conditions, geopolitical events, and market demand. Stay informed about these factors and consider them when making your purchase.

-

Be Aware of Additional Costs: In addition to the price of the gold bar, consider any additional costs such as shipping, insurance, and storage fees. These costs can affect the overall value of your investment.

Conclusion

The 20g gold bar offers a practical and accessible way to invest in gold. Its affordability, portability, and liquidity make it an attractive option for a wide range of investors. Whether you're looking to diversify your portfolio, secure a tangible asset, or find a unique and valuable gift, the 20g gold bar provides a solid foundation for investing in precious metals. By choosing reputable dealers, verifying authenticity, and considering storage and market conditions, investors can confidently add 20g gold bars to their investment strategy.